In our companion post, we highlighted how the pandemic and subsequent policy actions disrupted trends in the growth of student loan balances, the pace of repayment, and the classification of delinquent loans. In this post, we discuss how these changes affected the credit scores of student loan borrowers and how the return of negative reporting of past due balances will impact the credit standing of student loan borrowers. We estimate that more than nine million student loan borrowers will face significant drops in credit score once delinquencies appear on credit reports in the first half of 2025.

We begin by discussing how the pandemic forbearance improved the credit scores of delinquent and defaulted borrowers. Next, we attempt to benchmark the potential stock of delinquencies that will be appearing on credit reports during the first quarter of 2025. Lastly, we look back to the period prior to the pandemic to gauge the impact that a new student loan delinquency has on a borrower’s credit score. For this analysis, we use the New York Fed Consumer Credit Panel (CCP) which is a nationally representative sample of credit reports from Equifax.

The Credit Score Impact of the Pandemic Forbearance

The pandemic forbearance on federal student loans naturally had a rather large impact on credit scores for affected borrowers. Page 8 of the Student Loan Update shows an 11-point increase in median credit scores for student loan borrowers from the end of 2019 to the end of 2020; however, these increases were particularly large for borrowers who had a previous delinquency. The chart below shows the median Equifax Risk Score among borrowers with a student loan in the first quarter of 2019, separately for those who had a delinquency in 2019 (gold line), those in default in 2019 (green line), and those who were current throughout 2019 (blue line) (note the initial fall for the gold line is driven by borrowers in that group falling delinquent in 2019).

The 2020 forbearance marked all delinquent (but not defaulted) loans as current, causing a jump of 74 points, from 501 to 575, in the median score between 2019:Q4 and 2020:Q4 for those borrowers who were previously delinquent but not defaulted. Since then, scores continued to rise for previously delinquent borrowers (as their negative remarks aged) while scores for previously current borrowers remained relatively flat.

Defaulted borrowers saw a gradual rise in credit scores as their negative marks aged and as some borrowers voluntarily rehabilitated their defaulted loans. However, in the fourth quarter of 2022, the Fresh Start program marked all defaulted loans as current, increasing the median score for those with a default in 2019 by 44 points, from 564 in 2022:Q1 to 608 in 2023:Q1. By the end of 2024, those borrowers with loans in delinquency or in default saw scores that were 103 and 72 points higher, respectively, than at the end of 2019. While these score increases are sizable, they were not large enough for the median score to escape subprime standing. In the overall student loan borrower population, Page 6 of the Student Loan Update shows that the share of borrowers with subprime credit scores (less than 620) decreased from 36.3 percent in 2019 to 28.3 percent in 2024.

Previously Delinquent Borrowers Saw Large Credit Score Gains During the Student Loan Forbearance

Notes: The chart above plots the median credit score for three groups of student loan borrowers who had outstanding balances in 2019:Q1. The blue line shows the median credit score for borrowers whose student loans were current in every quarter of 2019. The gold line shows the same statistic for borrowers with at least one delinquent (but no defaulted) student loan during at least one quarter in 2019. The green line represents borrowers with at least one defaulted student loan in 2019. Credit scores are Equifax Risk Score 3.0.

The Shadow Delinquency Rate of Student Loans

Delinquencies will hit credit reports over a rolling window as borrowers with missed payments advance beyond 90 days past due. As such, the 2025:Q1 Quarterly Report on Household Debt and Credit will likely reveal a significant uptick in the delinquency rate for student loans, but the size of this increase is difficult to pin down. In advance of this release, we attempt to estimate the scope of delinquent student loans at the end of the on-ramp by combining the most recent data (as of September 30, 2024) from Federal Student Aid (FSA) with data from the CCP from the same time.

We estimate a “shadow delinquency rate” by summing the total volume of loans not owned by the federal government that were 30 or more days past due from the CCP with the total volume of loans 30 or more days delinquent from FSA in each quarter. Additionally, we manually flag federal student loans serviced by the defaulted loan servicer as past due beginning when payments resumed since these loans will also report as past due. We then divide the total estimated volume of delinquent debt from these sources by the total outstanding student loan balance from the CCP to compute the share of balances more than 30 days past due.

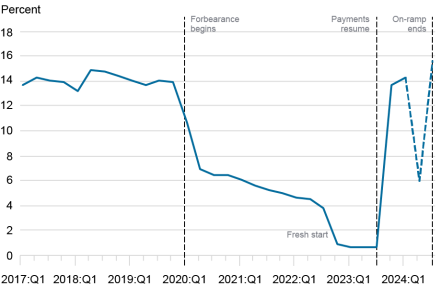

The chart below shows the shadow delinquency rate since the beginning of 2018. Prior to the pandemic forbearance, the series reached a high of 14.8 percent in the second quarter of 2018 and hovered near 14 percent throughout 2019. As discussed above, the delinquency rate fell at the start of the pandemic as loans were cured and due to the Fresh Start program. After payments resumed, the volume of past due federal loans quickly returned to pre-pandemic levels and reached a new high of 15.6 percent by the end of the on-ramp period, with more than $250 billion in delinquent debt held by 9.7 million borrowers.

A Larger Share of Student Loan Balances Was Past Due After the On-Ramp than Before the Pandemic Forbearance

Notes: The chart above represents the share of student loan balances more than 30 days past due. The “shadow delinquency rate” is computed by combining federal defaulted and non-federal delinquent loans from the CCP with federal delinquent loans from FSA (since delinquent federal loans were not reported to credit bureaus during the on-ramp). The volume of delinquent debt from FSA dropped in 2024:Q2 (as shown by the dashed line) due to the way the Education Department was resetting the status of past due loans back to current during the on-ramp. After borrowers exceeded 90 days past due, loans were reset back to current status.

Of course, the scale of past due loans may have shifted since the end of the on-ramp. Borrowers who were past due could have cured by the end of the first quarter, and other borrowers have likely since fallen delinquent. Additionally, several court cases affect the payment status of borrowers. Applications for Income-Driven Repayment (IDR) plans are suspended and borrowers enrolled in the SAVE Plan are in forbearance due to federal litigation of the SAVE Plan. As a result, borrowers cannot enroll in IDR plans that might make monthly payments more affordable while other borrowers in the SAVE plan cannot fall delinquent while in forbearance. The net impact of these factors is ambiguous but should be clarified when FSA releases new data updated through the end of 2024 and when we release the 2025:Q1 Quarterly Report on Household Debt and Credit.

The Credit Score Impacts of a New Student Loan Delinquency

According to these numbers, it is reasonable to expect student loan delinquency to surpass pre-pandemic levels when new delinquencies hit credit reports. Although some of these borrowers may be able to cure their delinquencies—either through making up missed payments or by entering an administrative forbearance with their loan servicers—the damage to their credit standing will have already been done and will remain on their credit reports for seven years. Using data from 2016 to 2019, we estimate the credit score impact of a new reporting of a 90 (or more) days past due student loan delinquency by borrower credit score band prior to the delinquency. The table below depicts those estimates, revealing those with superprime credit scores (760 or higher) before the delinquency saw average credit score declines of 171 points associated with a new delinquency and those with subprime credit scores (led than 620) saw average declines of 87 points.

A New Student Loan Delinquency Can Reduce Credit Scores by More than 150 Points

| Credit Score Before New Delinquency | Average Credit Score Change Associated with New Student Loan Delinquency |

| Less than 620 | -87 |

| 620-659 | -143 |

| 660-719 | -165 |

| 720-759 | -165 |

| 760 or higher | -171 |

Notes: The table above shows the average change in credit score for borrowers the quarter after they experienced a new delinquency of 90 or more days past due. We limit the sample to borrowers who experienced such an event between 2016:Q1 and 2019:Q4 and isolate to only borrowers’ first such event. We then compute the average change in credit score separately by credit score bands in the quarter before the delinquency first appears on the credit report. Credit scores are Equifax Risk Score 3.0.

Given these estimates, we expect to see more than nine million student loan borrowers face substantial declines in credit standing over the first quarter of 2025. The aggregate impact on overall credit access due these declines in credit scores will depend on the previous credit standing of those with past due loans. If missed payments come largely from those with lower scores, the aggregate impact will be smaller because those with low credit scores will see smaller declines and already have relatively limited credit access. However, if prime and superprime borrowers fell behind on student loan payments, the aggregate drop in credit standing among student loan borrowers could be much larger. This would result in reduced credit limits, higher interest rates for new loans, and overall lower credit access. Over the coming months, we will continue to monitor the state of student loan delinquency as new data become available.

Daniel Mangrum is a research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Crystal Wang is a research analyst in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Daniel Mangrum and Crystal Wang, “Credit Score Impacts from Past Due Student Loan Payments,” Federal Reserve Bank of New York Liberty Street Economics, March 26, 2025, https://libertystreeteconomics.newyorkfed.org/2025/03/credit-score-impacts-from-past-due-student-loan-payments/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).